Yesterday an announcement from the Department of Transportation of over $600M in project grants for new charging projects caused lots of buzz in the EV community. The full list of the grant recipients can be found here.

Today I will dig into these new developments, the background of the program that awarded the grants, the grant locations and recipients themselves, and implications for the EV trucking industry.

Background on the CFI

From the Federal Highway Administration’s website, the Charging and Fueling Infrastructure (CFI) Program:

is a competitive grant program created by President Biden's Bipartisan Infrastructure Law to strategically deploy publicly accessible electric vehicle charging and alternative fueling infrastructure in the places people live and work – urban and rural areas alike – in addition to along designated Alternative Fuel Corridors (AFCs). CFI Program investments will make modern and sustainable infrastructure accessible to all drivers of electric, hydrogen, propane, and natural gas vehicles.

This program provides two funding categories of grants:

(1) Community Charging and Fueling Grants (Community Program); and

(2) Alternative Fuel Corridor Grants (Corridor Program)The Bipartisan Infrastructure Law provides $2.5 billion over five years for this program to strategically deploy electric vehicle (EV) charging infrastructure and other alternative fueling infrastructure projects in urban and rural communities in publicly accessible locations, including downtown areas and local neighborhoods, particularly in underserved and disadvantaged communities.

As a refresher, the Bipartisan Infrastructure Law allocated over $100 billion for public transportation projects – the largest federal investment in public transportation in US history. A subset of this massive bill flows into the CFI grants that we are now seeing materialize. You can expect to see additional grants in future years until the full $2.5 billion is earmarked.

Where are the funds going?

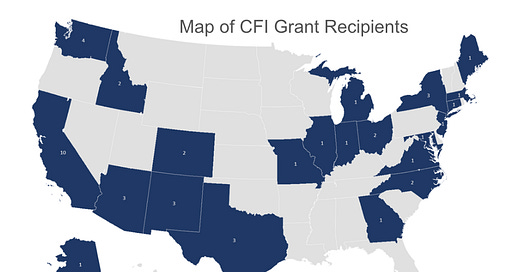

~$623 million in grants were awarded to 47 projects across 22 states and Puerto Rico.

Here is the map with each project listed by state. California, unsurprisingly, received the highest total number of grants from a sheer project perspective (10) and from a dollar perspective ($168M). Texas was second in dollars ($100M), while Washington state was second in projects (4).

The DOT also provided data on the dollar value and type of each individual project. See below for the breakdown of project type (EV charging site or hydrogen refueling site), the dollar value, and the location. I found it interesting that the largest project funded was actually for hydrogen refueling stations in Texas, not EV charging in California as I would have guessed.

I also found it notable that only 4 of 47 projects are over $50M, while the remainder are all under $20M. Keeping the majority of awarded grants at or under the $20M line allows for the funding to be spread out over more projects as opposed to large investments in concentrated areas.

I expect in future years we see a similar total distribution size. With $2.5 billion to dole out over 5 years across three more rounds, it seems likely that future recipients will see an additional ~$600M in grants each round.

Who is getting the money?

I’ll take a look at some of the top projects and then discuss all projects in general.

Texas - Charging and Fueling Infrastructure (CFI) Corridor Program for the Texas Hydrogen and Electric Freight Infrastructure (Tx–HEFTI) Project - $70M

I was only able to find limited information about this project, despite being the largest project awarded in the grants. In March of 2023 the North Central Texas Council of Governments (NCTCOG) released a “Call for Partners” requesting private proposals for buildout of a “charging hub for battery electric trucks and a network of hydrogen fueling stations along the Texas Triangle to support the adoption of zero-emission medium- and heavy-duty vehicles.”

Further reporting on this award indicates that the money “will go to build five hydrogen fueling stations around the Texas Triangle, which encompasses Houston, Dallas-Fort Worth, Austin and San Antonio.”

In June of 2023 the City of Denton, a suburb of the Dallas-Fort Worth area, passed a resolution supporting the NCTCOG proposal. I cannot find any additional information about any private companies involved, so we will have to wait for more details on this project.

New Mexico - Clean Fuel Build–out Project for Medium – and Heavy–duty Electric Corridors along Interstate 10 Unincorporated Hidalgo and Dona Ana Counties - $64M

This project represents the first heavy duty truck charging infrastructure investment in the Southwest, and it’s a big deal.

In a joint business press release by the New Mexico Department of Transportation and TeraWatt Infrastructure, they announce that “TeraWatt will construct two EV charging centers for medium and heavy-duty commercial electric vehicles in Lordsburg and Vado, New Mexico. Each site will have nine pull-through stalls and…will be able to provide about 300 truck charges per day.”

You can find more specifics here and more quotes from company and public officials.

California - FY 2023 San Joaquin Valley I–5 Electric Freight Corridor (Valley EFC) Project - $56M

The first and largest of the California projects on the list, this grant is for “the construction of two state-of-the-art truck charging sites in Taft and Gustine to support two of the nation’s busiest freight corridors.”

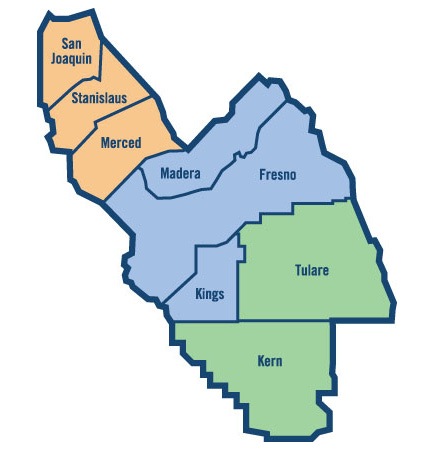

For those not fully up to speed on California geography (like me), here is a map showing the San Joaquin Valley Air Pollution Control District area (it spans 8 counties in the Central Valley region) and the two planned charging sites the right along the I-5 corridor (the red pin is Gustine and the star is Taft).

I can’t find additional details on whether there are any private companies involved in the buildout of these two truck charging depots. Their location, however, is ideal for the thousands of trucks that travel on I-5 every day.

All projects

From the first section on the CFI, we know that there are two categories of grants, Community Grants and Alternative Fuel Corridor Grants. $310M went to 36 community projects versus $312M for only 11 corridor projects.

The corridor projects on average come out to more than 3x the size of community projects, highlighting the different types of charging needs that the CFI Program aims to address. Corridor projects need to be large enough to accommodate high traffic and concentrated, frequent use. Community projects need to connect a wide variety of folks across a large area that typically hasn’t been served by EV charging development to date.

Grants specifically targeted at building EV fast-charging infrastructure and/or hydrogen fuel depots for medium- and heavy-duty trucks won over $250 million, representing 41% of awarded funds.

EV charging grants in general earned 84% of funding while hydrogen fueling station proposals received the remaining 16%.

The grants announced yesterday will lead to the construction of an estimated 7,500 EV charging ports. More than 70% of grant dollars are slated for projects in disadvantaged communities, including rural, poorer urban, and tribal lands where EV charging infrastructure does not yet exist.

What does this mean for EV trucking?

Overall, this is great news for the blossoming EV trucking industry. More publicly available charging means more owner operators and small trucking firms are able to access the means to charge their new EV trucks. Building out charging stations along the already identified Alternative Vehicle Corridors is a no-brainer. Private and public researchers have already identified these Corridors as high-density routes that will greatly benefit from EV charging infrastructure investment.

Gabe Klein, the Executive Director for the U.S. Joint Office of Energy and Transportation, said in a LinkedIn post yesterday that there will be “three more rounds of funding coming very soon” for additional project grants, and that “there were $3.7B in applications!”, ~6X more in submitted projects than eventual awarded grants.

The excitement around EV charging and infrastructure projects like these is exactly what we need to continue moving forward in the electrification journey for commercial trucking. Incentivizing state and local governments to pursue these projects benefits the entire industry, helping eliminate harmful diesel emissions and modernize our transportation system.

It makes sense that Texas would lean into hydrogen (and compressed natural gas) infrastructure as both are pretty opportunistic for the bigger players in the state right now. I suspect we'll see further funding for hydrogen corridors close to the hydrogen hubs. Here's an article (shameless self promotion!) that talks about the hydrogen hubs being a boon for natural gas producers that might pair well with this sterling article :-)

https://sustainableadvantages.substack.com/p/clean-hydrogen-hubs-winners-and-losers

Disappointing to see that neither PA nor DE received any grants for improving EV infrastructure. Both states sorely need it!