Comparing Heavy-Duty (Class 8) Battery Electric Trucks Currently Available in the US Market

A brief look at what's out there today

Introduction

The logistics industry is experiencing the beginning of a transformational shift. Market and government forces are quickly coalescing to accelerate the adoption of electric vehicles for commercial transportation, building off of the significant growth in personal EVs.

While many people recognize EV offerings from legacy auto manufacturers like Ford, GM, or Chrysler and from new companies like Tesla or Rivian, few know the key models or companies leading the commercial EV transition. Heavy-duty Class 8 trucks are a critical part of this transition and it is important to understand the currently available options for truck drivers and fleet owners looking to go electric.

This article will provide in-depth comparison of the Class 8 Battery Electric Trucks in the U.S. market. We'll evaluate essential criteria such as price, range, charging infrastructure, and more.

Available Market-Ready Options

Tesla Semi

Price: Initially set at $150,000 in 2017, estimated around $250,000 now per recent reporting

Range: either 300 or 500 miles, depending on the model

Charging: Tesla Supercharger network; 70% of range in 30 mins of charging

Freightliner eCascadia

Price: Estimated around $400,000

Range: 250 miles

Charging: 70% charge in 90 mins

Volvo VNR Electric

Price: Available via lease; pricing details proprietary

Range: 275 miles

Charging: CCS1 and CCS2 available, up to 250 kW; 80% charge in 90 mins

Kenworth T680E

Price: Estimated around $450,000

Range: 200 miles

Charging: 100% charge in 3 hours

Analysis

Price

The upfront capital required to purchase a new battery electric truck is a significant barrier to entry, especially for small fleet owners, due to thin operating margins in the logistics industry.

Tesla Semi offers the most competitive pricing at an expected $250,000 for a range of 300 miles, but has limited marketing or distribution potentially making it difficult to purchase.

The eCascadia and the T680E are priced at a premium but come backed with decades of truck development from Daimler Trucks and Kenworth and are more geared towards the owner/operator segment, with inventory available at many truck dealerships around the nation.

The VNR Electric is available only via leasing, making it hard to directly compare pricing.

Range and Efficiency

For truckload routes that exceed 300 miles without convenient charging infrastructure, Tesla Semi takes the lead with up to 500 miles of range.

The other offerings are more optimized for local, city, and short-haul deliveries. It's important to consider both battery range and payload weight when selecting an electric truck, as range decreases with increased weight.

Charging Infrastructure

Tesla has the advantage of its well-established Supercharger network enabling faster charging times. The other three trucks use standard charging plugs, making them compatible with existing EV charging stations but at slower charging speeds.

Some large shippers or fleet owners like Pepsi and Schneider are building faster charging infrastructure at their existing facilities to capitalize on downtime or when loading/unloading freight.

Comparing Available Options

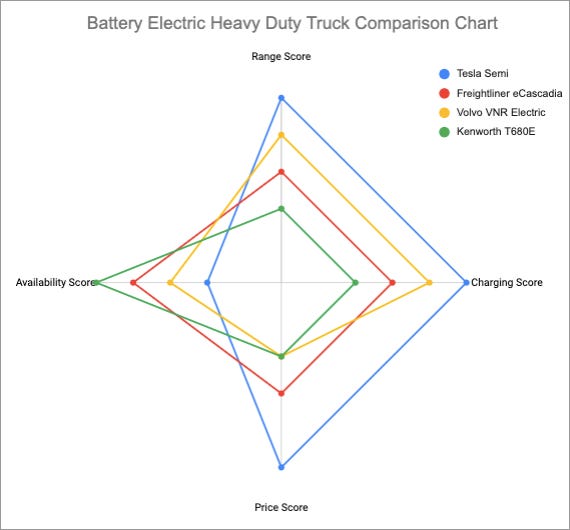

Below is a ranking of the trucks against several key criteria used when evaluating a battery electric vehicle: range, charging, availability to purchase, and price.

Speculative Future Trends

Given the interest in hydrogen fuel cells as an alternative to battery-electric solutions, it's possible that we will see Class 8 trucks powered by hydrogen on the road in the next five years. Companies like Hyundai and Nikola Motors are already in the race, but their products are in early stages of market readiness.

If hydrogen storage and transmission infrastructure can rapidly develop we could easily see a mixed future of both battery electric and hydrogen fuel cell electric vehicles, split along haul length, ease of refueling, and total cost of ownership.

Conclusion

When choosing a Class 8 battery electric truck it is important to consider the route type, the anticipated payload needs, the availability of charging infrastructure, the initial price, and the total cost of ownership.

Tesla Semi offers excellent range and pricing but may not be the best option for short-haul routes with high payloads, and may not be available due to limited production.

Freightliner and Kenworth offer premium features that may justify their higher pricing for specific use-cases.

Volvo provides a different pricing model altogether that might appeal to operators not looking to commit capital upfront.

There are many models that did not get reviewed in this initial spotlight. If you have a truck that you would like to see reviewed please add it in the comments or send me an email at hello@evtrucking.news.